January 28 is EITC Awareness Day, and it’s time to make this essential credit equitable. The Earned Income Tax Credit (EITC) is a refundable, earnings-based credit low-to moderate-income working families receive when they file taxes. It is also one of the country's largest anti-poverty programs and is associated with improving children’s educational and health outcomes.

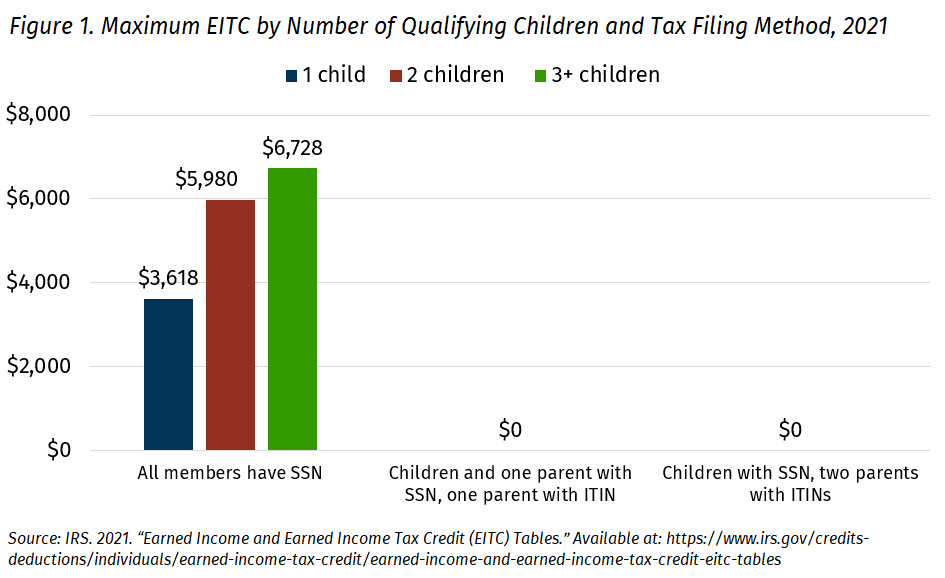

Despite the proven success of the EITC, many children in immigrant families are denied its benefits simply because a member of their family uses an Individual Tax Identification Number (ITIN) instead of a Social Security number (SSN) to file their taxes. To receive the EITC, all family members must have an SSN. So, if just one family member has an ITIN, the entire family—including those family members who are U.S. citizens—is ineligible for the EITC. These families lose thousands of dollars in tax credits each year.

This exclusion is a racial/ethnic equity issue. Hispanic children have the highest child poverty rates in the U.S. and 54% of them have at least one immigrant parent. Restrictive EITC eligibility rules mean Hispanic children do not benefit as much from the EITC as other children. To create an EITC that is effective and equitable, it is essential that all children who meet the income eligibility requirements receive it, regardless of the type of tax identification number their parents use. These changes will ensure that more immigrant families and Hispanic families have the basic economic resources their children need to thrive.

Read our 2021 year-end brief on reducing child poverty equitably

Learn more about including immigrant children in the safety net